As an investor, choosing the right market to grow your superannuation is key to securing a comfortable future. While Australian markets, like the ASX, are heavily correlated with global markets such as the US S&P 500, it’s important to understand that the ASX has underperformed the S&P 500 by a significant margin since the Global Financial Crisis in 2008. The S&P 500 has risen 305%, while the ASX200 has only seen a 119% increase in the same period. This underperformance is especially relevant when planning for your retirement, as the returns from the Australian market alone may not be enough to meet your future financial goals.

At DS Financial, we specialize in providing clients with access to high-growth global markets that outperform traditional Australian investments. Our international approach is backed by cutting-edge technology, including AI-driven tools, to ensure that your funds are making the most of global opportunities. Here’s why you should consider us to manage your superannuation:

The ASX, while correlated to global markets, simply hasn’t kept up with the growth of the US stock market. The S&P 500 has vastly outpaced the ASX, thanks to factors like higher P/E ratios and more reinvested earnings in US companies. This deviation highlights the importance of seeking higher-growth markets outside Australia for your superannuation. At [Company Name], we focus on international investment opportunities that consistently outperform the ASX, giving your superannuation the chance to grow faster and with higher returns.

We use the most advanced AI technology, including licensing BlackRock’s Aladdin, the world’s leading risk management platform, to ensure that your hard-earned money is managed with the utmost care. This AI allows us to make data-driven decisions, minimizing risk while maximizing growth potential. With this technology and a fiduciary responsibility to protect your assets, you can rest assured that your superannuation is in safe hands, enabling you to sleep easy at night.

We don’t limit your investments to Australia. Our expertise in international markets—including high-yield property investments in Dubai, London, and other global hotspots—gives you access to superior returns. You can also invest in top-performing cryptocurrencies, ICOs, and ETFs, tapping into exclusive trading opportunities not available through traditional Australian avenues.

Australian markets, especially in resources, often face periods of volatility tied to the global economy—such as fluctuations in commodity prices or downturns tied to specific countries like China. By diversifying your investments internationally, you tap into opportunities that are less exposed to such volatility, ensuring your super is not at the mercy of local market trends.w

As an investor, choosing the right market to grow your superannuation is key to securing a comfortable future. While Australian markets, like the ASX, are heavily correlated with global markets such as the US S&P 500, it’s important to understand that the ASX has underperformed the S&P 500 by a significant margin since the Global Financial Crisis in 2008. The S&P 500 has risen 305%, while the ASX200 has only seen a 119% increase in the same period. This underperformance is especially relevant when planning for your retirement, as the returns from the Australian market alone may not be enough to meet your future financial goals.

At DS Financial, we specialize in providing clients with access to high-growth global markets that outperform traditional Australian investments. Our international approach is backed by cutting-edge technology, including AI-driven tools, to ensure that your funds are making the most of global opportunities. Here’s why you should consider us to manage your superannuation:

This AI allows us to make data-driven decisions, minimizing risk while maximizing growth potential. With this technology and a fiduciary responsibility to protect your assets, you can rest assured that your superannuation is in safe hands, enabling you to sleep easy at night.

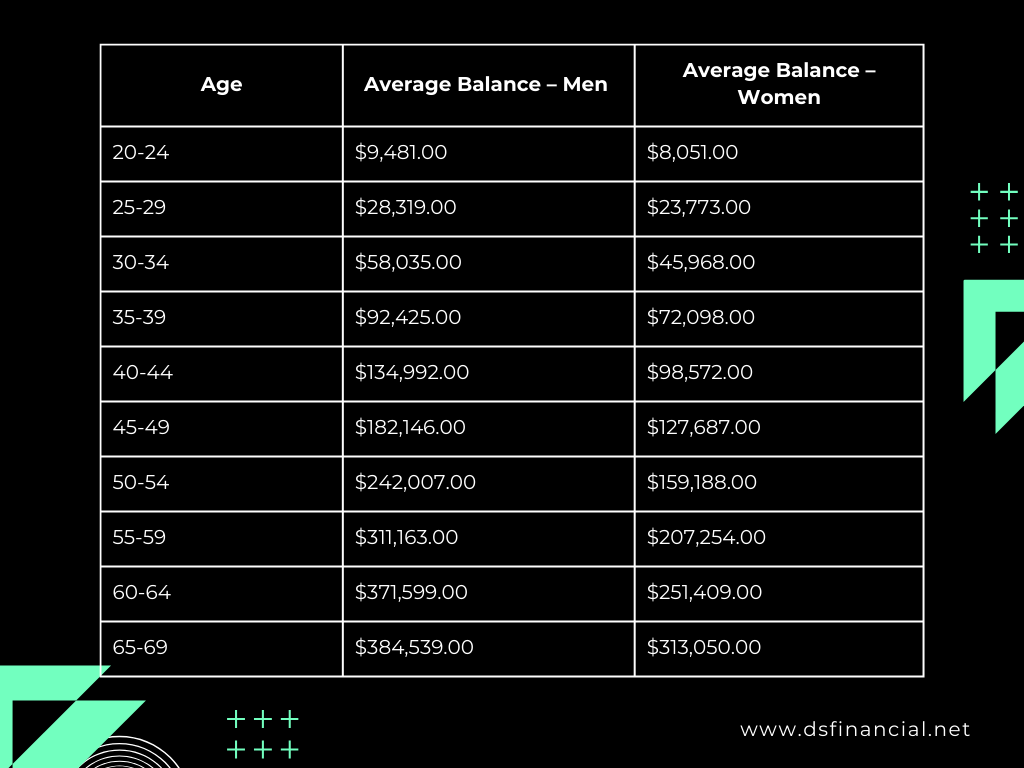

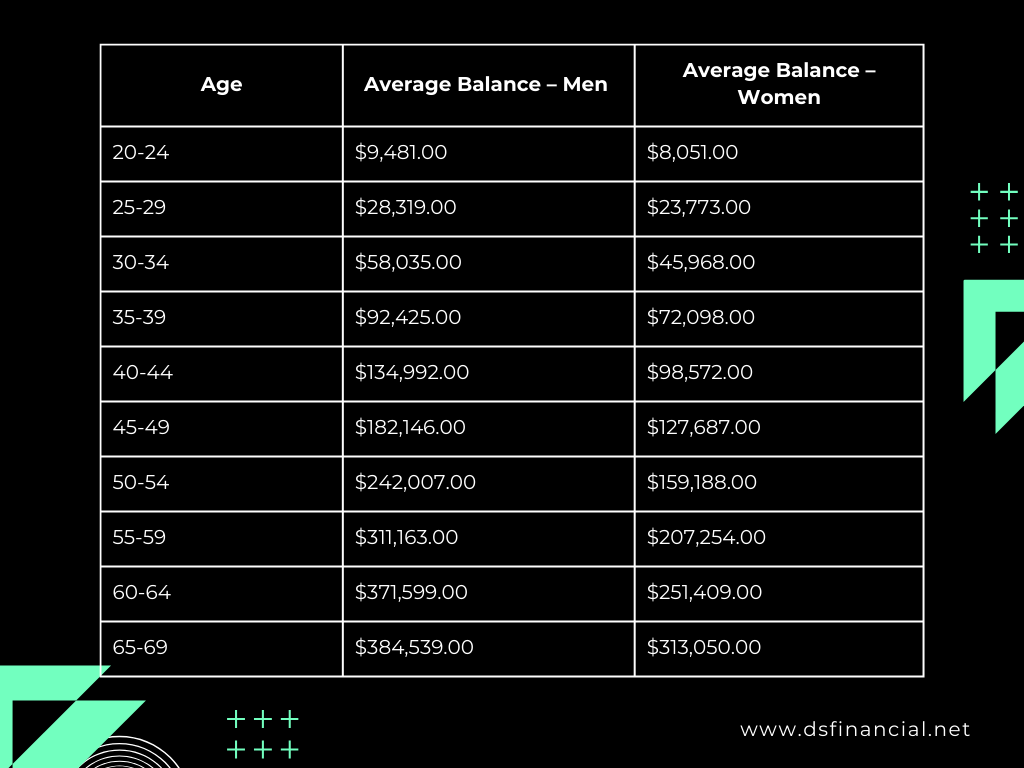

While these are averages, it’s important to note that you may need higher returns to ensure your retirement is comfortable. For example, individuals in their 30s to 40s typically need faster-growing investments to secure a better retirement lifestyle.

All DS Financial accounts are self-guided, trusted by more than 280,000 clients. We offer tools that let you manage your investments independently. Users are responsible for their own decisions and account activity. Our platform is built to support your goals, not control them. We do not provide financial advice, only access to features that help you grow with confidence. By using our system, you accept full responsibility for outcomes. Always invest with caution and stay informed. Markets can shift quickly. Stay aware, stay in control. DS Financial gives you the space to lead your own path forward.